Billing a customer

Pre-billing process - Creating a new customer in UniFi

Billing a customer in UniFi is the process of billing a customer for the supply of goods or services on extended credit under a set of conditions. For example, the mandatory condition for Low risk entities is obtaining a purchase order, but for Medium and High risk entities, there are different conditions that need to be achieved.

Before goods and services are provided and subsequent billing can commence for any new customer, a risk assessment is required to minimise the risk exposure to UQ and to validate the new customer's details:

- Complete a new customer request form and send it to the Accounts Receivable (AR) team.

- The AR team will identify the customer type.

- If the customer is a Low risk entity, AR will advise the initiator to request a purchase order (PO) before providing goods or services.

- If the customer is not a Low risk entity, AR will advise what steps are required next to achieve a Low risk outcome prior to providing goods or services.

Risk assessment process

It's the responsibility of the AR team to assess credit risk on behalf of UQ.

The table below summarises the initial risk types assessed, the subsequent account treatment and the security type required to maintain a Low standard of risk at UQ.

| Risk Type | Entity Types | Account Treatment | Security Type Conditions | Mandatory Documents (by order of priority) |

|---|---|---|---|---|

| Low |

| Credit sales on account | N/A | PO only |

| Medium |

| Credit sales on account |

|

|

| High |

| Cash sale payment in full before providing services, where High risk cannot be reduced to Low risk | Prepayment in full |

|

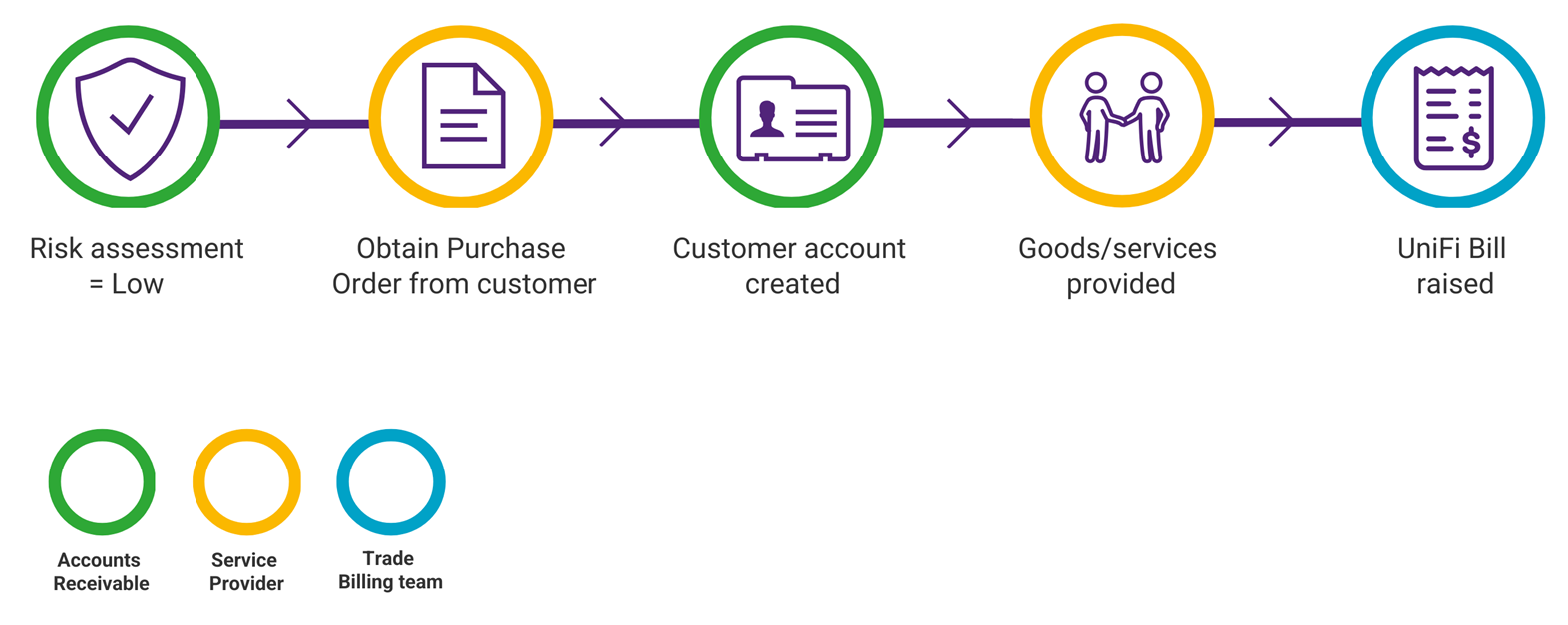

Low risk entities

For all domestic government, educational and (most) publicly listed entities, the conditions do not apply, but obtaining a purchase order is a mandatory requirement before goods or services can be provided and before billing can commence.

Low risk process

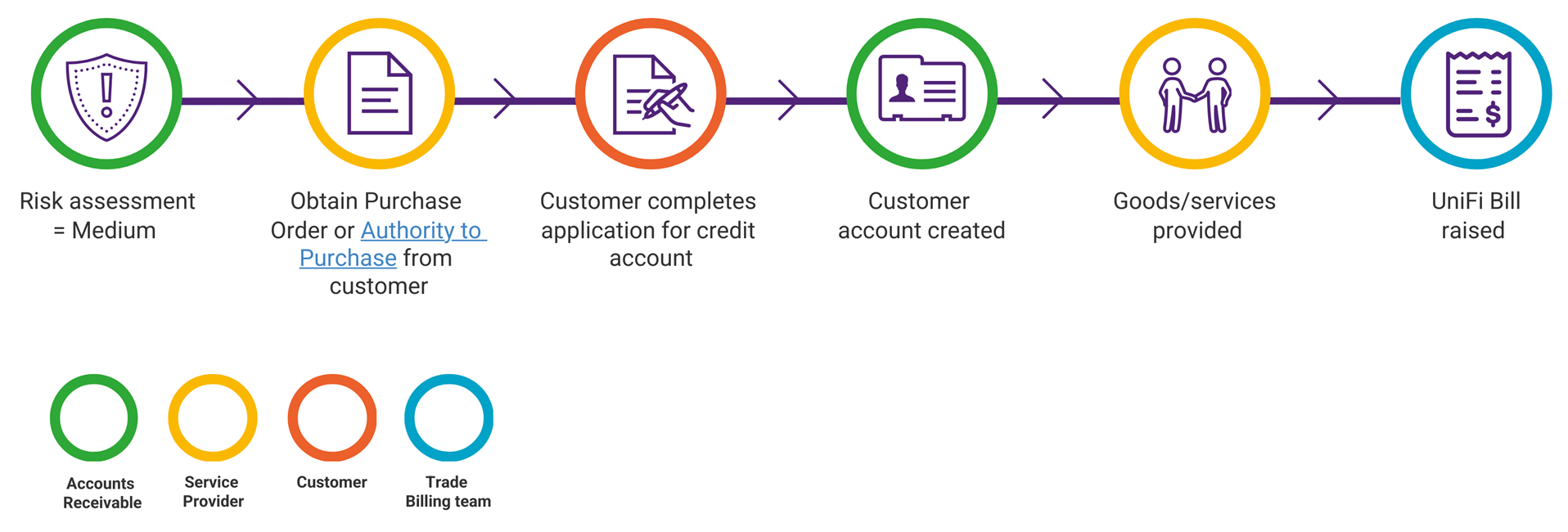

Medium risk entities

For all other types of entities, before goods or services are provided to a customer and before billing can commence, it is essential to ensure the risk to UQ is low. The AR team will endeavour to reduce a Medium or High risk outcome to low. If that cannot be achieved, certain conditions will be required to be met before the assessment process is completed, including:

- Requesting the customer to complete and sign a credit application form

- Registration of security to UQ

- The UniFi customer account operates within an approved credit limit

Medium risk process

When billing a customer in UniFi does not apply

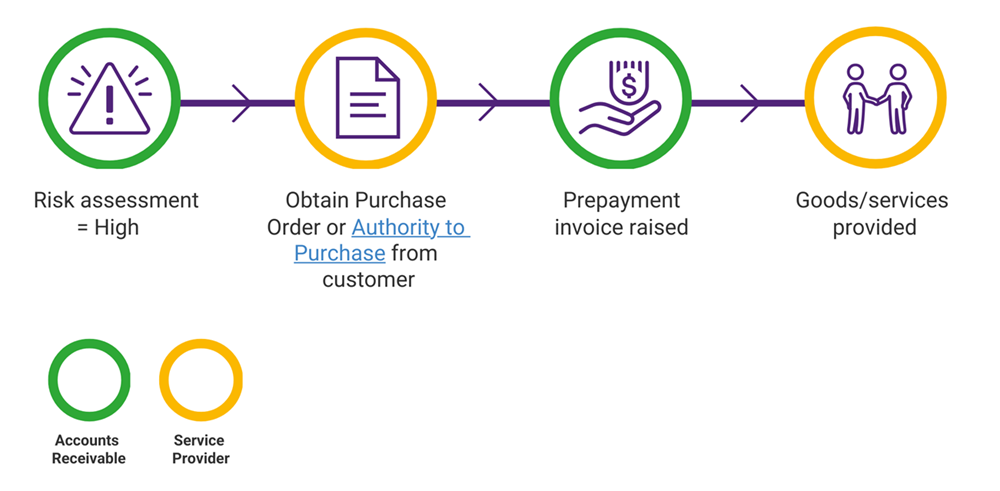

High risk entities

When the risk to UQ is High, and a Low risk outcome can't be achieved, the customer will be required to make full payment to UQ before the goods or services are provided.

High risk process

The AR team will process a non-UniFi cash sale invoice for the customer to pay on zero terms, and once full payment has been received, the goods or services may then be provided to the customer. This process is called prepayment, and the steps involved are provided below.

Prepayment

- A risk assessment performed by AR for a new Trade customer account has a High risk outcome that doesn't support extending credit terms for the supply of goods or services

- AR will make a recommendation to the service provider to reduce the risk (to UQ) to Low by requesting prepayment for services before providing them

- The service provider will request that the customer provide a PO, which must be sent to the AR team to raise a cash sale invoice for the customer to pay

- A prepayment invoice can be created by the AR team and dispatched via UQPay

- The customer makes payment online

- AR advises the service provider that payment has been received

- Services can be provided to the customer to the value of the payment.

Billing an existing customer

To bill a customer for goods or services, an invoice is generated in UniFi. The standard default payment terms for invoices raised in UniFi is 30 days from the invoice date. Payment options are listed on the invoice.

How to get a trade bill raised?

Before you engage in the supply of goods and services to your customer, your first step is to check whether the customer is an active UniFi customer, which is where we can help.

- Check if the customer is listed in the UniFi Customer List (staff login required) spreadsheet.

- If the customer doesn’t exist in UniFi, complete a new customer request form and send it to the AR team for processing.

- If the customer exists in UniFi, send your billing request to the Trade Billing team, including:

- customer purchase order OR Authority to Purchase form (signed by the customer)

- supporting executed contract/agreement if applicable

- chart string details (Contact your local Advisory team if you need assistance).

Overdue and unpaid invoices

If a payment is overdue, AR will:

- generate a series of reminder notices, which may include a final demand for payment after the bill is 90 days old

- contact your customer to enquire why the invoice has not been paid

- contact you to assist in collecting the overdue invoice if the customer's response is unsatisfactory.

If it is likely an invoice isn’t going to be paid, the AR team will work with your organisational unit to decide what to do next. For example:

- adjusting or cancelling the invoice

- referring the matter to an external recovery agency, which may incur additional costs to your area

- creating a provision for bad and doubtful debts to prepare for potential bad debt loss.

Refer to the Credit, Pre-Billing and Collections for more detailed procedures for management of overdue debt and debt write-off.

Requesting external debt collection

If an external debt collection agency is required, you need to:

- Collate any customer contact information and supporting documents, including all invoices and records of correspondence with the customer.

- Complete a request for debt collection form (DOC, 68 KB), with approval from an appropriate financial delegate.

- Email the form and supporting documents to Accounts Receivable.

- If you receive any payments from the customer after you’ve requested external debt collection, contact the Accounts Receivable Credit Controller you’ve been working with.

External debt collectors charge a commission on amounts they collect. This commission will be charged to your nominated chart string.

Funds recovered by the external debt collectors will be allocated to your nominated chart string.

Adjusting incorrect invoices

If the invoice is incorrect in some way, you can request an adjustment to the invoice by completing an Adjustment Note Request (DOCX, 43.4 KB).

Completing customer registration forms

If you receive a request to complete a customer registration form (a due diligence request) on behalf of your business unit, please note that some sections can be completed by local unit staff, while others need to be forwarded to the Accounts Receivable team for completion.

The list below includes information commonly requested on customer registration forms and who can complete each section.

Accounts Receivable can complete:

- Bank account details and confirmation of bank account details for the UQ No. 1 and Student Fees bank accounts

- Online vendor registration process to gain access to a customer's invoicing portal

Staff members can complete:

- UQ postal address: The University of Queensland, Brisbane, QLD, 4072

- UQ phone number: +61 7 3365 1111

- UQ ABN: 63 942 912 684

- Remittance advice email: remittances@uq.edu.au

- Customer purchase order email: billingpo@uq.edu.au

- Accounts Receivable phone number: +61 7 3346 7711

- Invoice enquiries email: ar@fbs.uq.edu.au

Where to go for other requests on customer registration forms

Tax/business registration

- Contact the UQ Tax Team

Modern Slavery

- Contact antislavery@uq.edu.au

Completing Statutory Declarations

- These can be completed by the local business unit providing the goods or services to the customer

Insurance (UQ certificates of currency)

- Download from the Certificates of Currency, Forms & Facts Sheets page (staff login required)